We Ensure Best Service

Solutions Consulting has extensive experience in providing tax services to foreign and domestic enterprises with individuals and representative offices. Through its long and close working relationship with the tax authorities, Solutions Consulting offers comprehensive taxation services. These services include the development of tax optimization structures, transfer pricing policy aligned with the corporate strategy, compliance with Chinese tax regulations, liaising with tax authorities, and preparation and submission of tax returns.

- Accounting & Audit

- Tax Refund

- Annual Audit

- Tax Consulting

- Company Subsidies

- Social Insurance Services

What is WFOE Annual Report

This report includes 2 parts, company annual report and financial annual report

What type of company need to do the report

All companies, non-corporate legal persons, partnerships, sole proprietorships, branches and individual businesses registered and obtained business licenses before December 31st, 2019.

The vast majority of businesses require final settlement unless it is levied according to the amount of tax payable.

When do companies need to do the report

Every year from 1st January to 30th May.

What would happen if a company fail to submit the report on time or submit an inaccurate report

Companies which fail to submit the report on time would be listed as abnormal company and announced to the public, this would create a very negative image to the company. Tax office would also put these companies on the black list.

Companies didn’t hand in the report for 2 years, would be fined for 5000RMB.

Companies didn’t hand in the report over 3 years (including 3 years), would be fined for 10,000RMB.

What are the benefits for companies to do WFOE annual report

- Immigration will check the annual report for working visa renewal

- It could help company owner to understand the company operation status

- It helps company to get tax refund

- It helps company to reduce the probability of tax spot check

- It could decrease the financial risk for the company with a detail report

- If the report is done by a professional agent, it could even give companies suggestions for the financial state.

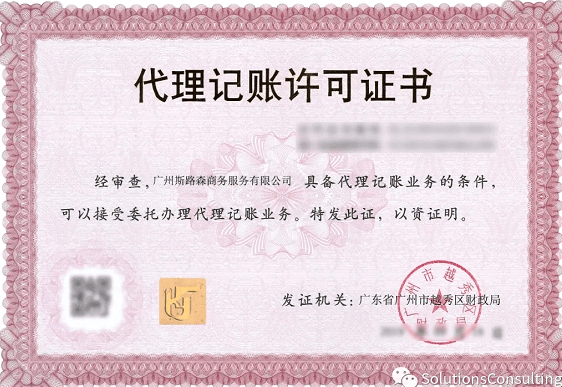

Tax and Accounting Permit of Solutions Consulting

1.The Meaning of Annual Renewal and Audit

The company annual renewal in HK means: When a HK company operates for one year, it must apply to the government for renewal.

It consists of two parts:

(1) Apply to the tax bureau for a new business registration certificate for the next year and pay the government fees at the same time.

(2)The second is the annual return, which records the latest information of the company, including the latest name of the company, the proportion of the members’ shares, the address of the Secretary, and the changes of the company in the previous year.

The company audit in HK means: Report tax to the tax bureau and to review company’s financial situation in the previous year. And the safety and rationality of the company’s finance would be assessed by independent accountants. In the 18th month of the company’s establishment, the accounting period is selected for the first time. After that, the accounting audit should be carried out every year.

2.The Difference of Annual Renewal and Audit

(1)Time

Annual renewal is conducted in the 12th month of the establishment of the company. Take a year as the unit, and it should be renewed every year.

The audit is carried out in the 18th month after the establishment of the company, and to choose the accounting period. After that, the audit will review the financial status of the company on an annual basis.

(2)Content

Annual renewal: It is necessary to update the business registration certificate, annual return form and renewal of registration certificate normally, which is a necessary update for each HK company on its establishment date every year.

Audit: The HK Licensed auditor shall verify the accounts of the HK company, issue an audit report and state and explain to the HK government departments responsibly in the form of relevant document reports.

HK Audit Report: Why it is So Important?

After 18 months of establishment, Hong Kong companies need to start to make audit and declare tax. Companies need to declare tax according to the actual business situation. However, many companies do not know how to declare their own company’s auditing. Please read the following articles patiently to find your answers to your questions:

What materials are required for audit

Basic information of the company; audit report of the previous year; monthly bank statements ; business document; expenses receipts (receipt could be proforma invoice).

How to choose a company's accounting time

It is usually about 12 months after company is registered. The longest time for accounting and audit is 18 months (including 18 months).

The maximum periode for the first reconciliation and audit is 18 months (including 18 months).

What are the categories of audit report opinion

Audit report opinions are divided into three categories:

1) Unqualified opinion: there is no opinion on the check of the financial statements of the enterprise, which means the company’s financial statements are fairly and appropriately presented.

2) Qualified opinion: the financial statements of the enterprise cannot objectively reflect the financial situation of the enterprise. Which means that the company financials are fairly presented, with the exception of a specified area.

3) No opinions: opinions that cannot be verified due to some external reasons, which means that the auditor is unable to complete the audit report due to absence of financial records or insufficient cooperation from the company.

The opinions of the audit report have an intuitive impact on the overall impression of the company by the bank, tax bureau and other government departments. Poor audit report is equivalent to not doing, and counterproductive.

How many kinds of accounting methods are there in Hong Kong

- Inactive Report

- Collection and payment purchase and sale / trade / actual operation

- Offshore exemption (Difficult to get approved by the bank. It requires a lot of information. Not recommended)

What is important for HK companies to do auditing and do accounting on time

1) Now the company is required to provide audit report for opening and maintaining of Hong Kong account.

2) Make a public trust report on the assets and operation to the society and specific departments (such as banks) and explain the operation of the company.

3) Base on section 373 (5) of the new Companies Ordinance Law, failure to keep proper accounting records is an offence. A fine of HK $300000 shall be imposed on the directors of the company, who shall be sentenced to 12 months’ imprisonment if it is found that they intentionally do so.

4) If a Hong Kong bank account is opened, the company still making zero accounting report. After verification, the Hong Kong Tax Bureau will impose a fine or even affect the closure of the account.

How to calculate the amount of tax

After the establishment of the company, it is necessary to declare the profit tax on an annual basis. The profit tax rate is 16.5% of the company’s net profit.

The profit tax is having a beneficial policy now: the profit tax rate of the first 2 million HKD of the company will be 8.25%, and the subsequent profits will continue to be taxed at 16.5%.

I believe you have known a lot more than before about Hong Kong audit report. To learn more about the Hong Kong account, please contact solutions consulting directly!

At Solutions Consulting, tax professionals experienced with many years of domestic taxation, handling are proficient in assessing tax risks of investment for clients. They can provide tax planning and consulting suitable to a company operating program, solve relevant tax issues for clients operating in Mainland China, and help foreign staff process their individual income tax and other services. Under our tax consulting service, corporations served by us will have a greater competitive edge.

Their willingness to customize their services to our needs stood out to us. And it really paid off.

John